日志

It is that over developed financial economy wild plundering real economy caused

||

It is that over developed financial economy wild plundering real economy caused economic downturn

--- One people created wealth to be plundered by more than 10 people

This is a re-edits by the excerpts from my article The speculators are destroying the foundation of Canadians survival and World economy will continue towards recession.

Frank Feb. 17, 2016, in Waterloo, Ontario, Canada

http://www.kwcg.ca/bbs/home.php?mod=space&uid=61910&do=blog&id=3968

This is a misleading world.

In the field of social governance, it dominated by so-called partisan politics that is gathering ignorant person to destruct human world.

In the field of social life, it dominated by so-called investment techniques that is to make money by money in plundering material wealth creation.

Currently, for the world economic downturn and worlds widely social unrest, people have ignored an important reason that is the over developed financial economy in over looting the social wealth by almost all-pervasive, to have greatly reduced the profit margins of material wealth manufacturers, thereby badly harmed real economy and made people’s lives increasingly difficult. This is the main reason for various social conflicts.

Bluntly say, the financial economy is that makes money by money for pursuing unearned interests. And the real economy is that creates life necessities for meeting human survival.

Historically, in the process of human civilization, financial economy has been playing an essential role. Whether the boom of Maritime Trade in Holland, or the construction of Erie Canal in the United States, were all financial economy contributed. Even in modern economy, it has been playing a key positive role.

However, anything over-developed are inevitable to extremes meet, in the current world, that over-developed financial economy is also playing a increasingly negative role.

For the overdeveloped financial economy, the professor of History of Harvard University Niall Ferguson made an introduction.

In the start of the documentary The Ascent of Money: A Financial History of The World that written and presented by the professor Niall Ferguson introduces with that: “In our time, we’ve witnessed the zenith of global finance. 2006,the world total economic output was worth around $47 trillion, that’s 47 followed by 12 zeroes, the total value of stock and bond markets was roughly $110 trillion, more than twice the size. and the amount outstanding of the strange new financial life form known as derivatives was $473 trillion, 10 times larger.”

As my view that stock and bond is rational, while financial derivatives, mostly, is irrational.

We can intuitively understand that, in 2006 world, each people created material wealth to be plundered by more than 10 people with the tools of financial derivatives.

In 2007, after working in U.S. financial system 23 years, Mr. Richard Bookstaber who published A Demon of Our Own Design, markets, hedge funds, and the perils of Financial innovation, in just before several months of the financial crisis outbreak. The book is noted for its foreshadowing of the financial crisis of 2007–08.

2013, American economist, Professor Robert Reich distills the story through the lens of widening income inequality to have presented documentary film Inequality for All. It indicates that income inequality currently at historic highs.

Over the last thirty years, before the latest recession, the U.S. economy doubled. But, these gains went to a very few: the top 1% of earners now take in more than 20% of all income—three times what they did in 1970. Inequality is even more extreme at the very top. The 400 richest Americans now own more wealth than the bottom 150 million combined. While this level of inequality poses a serious risk to all Americans.

In 1997 – 2007, in the United States, the finance was fastest development part of the American economy.

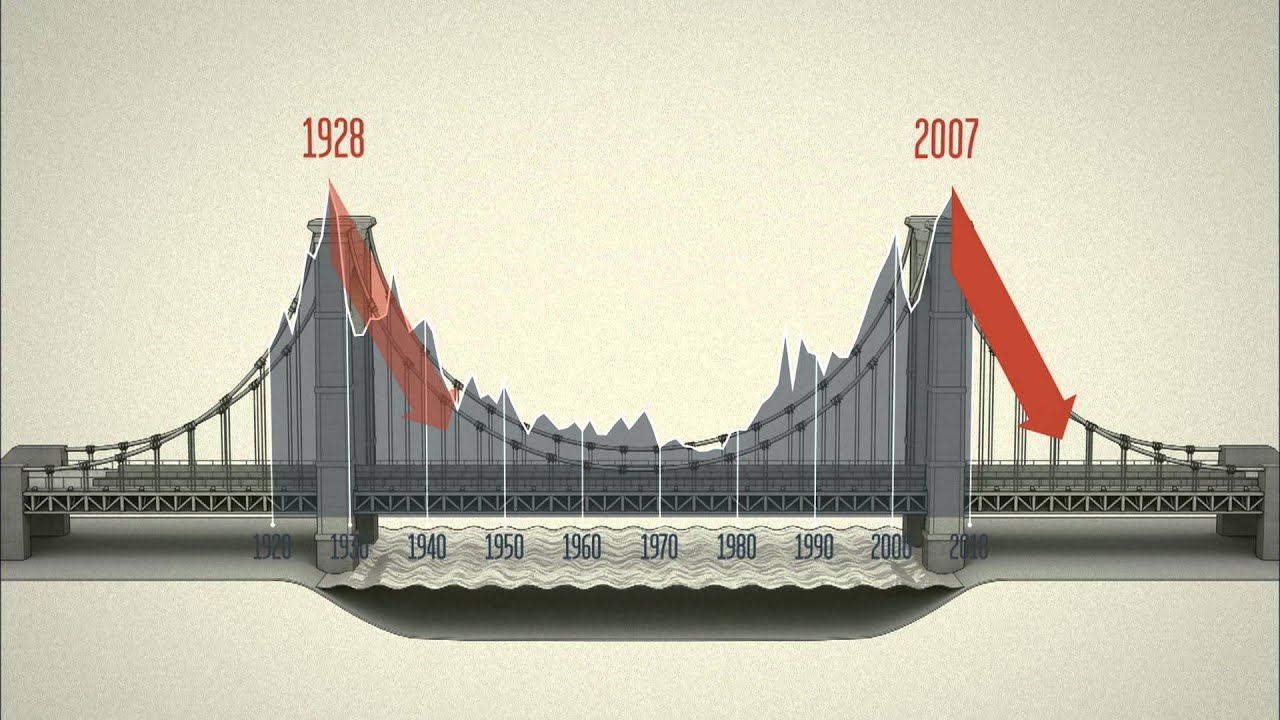

Following is the video screenshots from Inequality for All.

The two times economic crashes well match the peak point of income inequality at in 1928 and 2007. However, this trend cannot used to predict future trends due to in that period, world suffered World War II that interrupted normal development of economy.

From the peaks of relative financial wages, we can easily speculate the huge volume of financial economy or paper economy that is buying and selling on the financial markets to make money by money, in nature, the activities of financial economy are plundering real economy – that is actually producing goods and services, which is really relating the needs for human survival.

Due to that the activities of financial economy are speculating with currencies, stocks, and the materials for manufacturing, which will play a role of plundering real economy and also the money that gained in such activities has to be exchanged as material wealth for life survival finally, so that, in essence, those activities in financial markets is grabbing material wealth and is plundering the industrious people who are hard-working on creation of material wealth.

From above three photos, we can also easily speculate that, the two times economic crashes are caused by that wild developed financial economy.

Follow is the video screenshot from documentary Inequality for All.

In 2009, in the time of absolutely recession, the 7 highest paid Hedge funds managers were still taking more than Billions Dollar each.

In the documentary, the Professor Robert Reich appealed that: “Remember the government sets the rules at which the market functions.”

Anxious Professor’s cry is difficult to impress absurd politicians and greedy financial predators.

Until to today, the over-developed financial economy is still not under proper control. It is still in harming economy.

June 3, 2015, in article Canada Pension Plan must develop in kind base & as key body of state-owned economy, I once indicate the nature of income inequality.

“People hate social inequality and unfair with arguing that the Rich is too rich and the Poor is too poor. But, the tragedy that Greek Pensioner shoots himself to refuse to search for food in garbage revealed that:”

“The biggest social inequality is that rich individual with poor government.”

“The biggest social unfair is that a society is in favor of individual rich while government poor.”

“The saddest tragedy is that government of a nation is too poor to provide basic life-support for their national.”