日志

沉浮120年 通用电气被踢出 Dow Jones Industrial Average

|

再也无法代表美国!爱迪生创立的巨头 遭华尔街抛弃

0评论2018-06-20 15:05:35 来源:每日经济新闻 账户深套?试试这四个方法

连小学生都知道,托马斯·爱迪生是一位“发明大王”,他一生的发明共有两千多项,拥有专利一千多项:研究电灯、改进电话、研制直流发电机……

但爱迪生并不是卷缩在实验室里的“书呆子”,他还有一个身份——企业家。由他创办的最著名企业,当属美国通用电气公司(GE)。

1878年,爱迪生创立了爱迪生电灯公司。1892年,爱迪生电灯公司和汤姆森-休斯顿电气公司合并,成立了通用电气公司。

上世纪90年,它一度成为美国市值最大的企业;2008年,还是全球五大上市公司之一。

4年后,道琼斯工业股票平均价格指数问世,而通用电气成为最初的30只股票之一,直到昨天,它是道指原始股中,唯一保留的股票。

令人感慨的是,过去,通用电气代表了美国、甚至全球最尖端的产业,但进入21世纪,这家百年老店也不免遭到新经济的冲击。

今天(6月20日),时隔111年,通用电气再次被剔除出了道琼斯指数。究其原因,是因为通用电气过去12个月内,股价暴跌超过了50%。

标普道琼斯:通用电气无法代表美国经济了

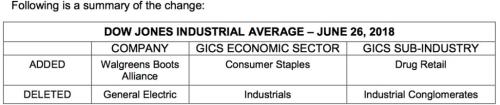

北京时间6月20日凌晨,美国股市收盘后,标普道琼斯指数委员会发布公告称,工业巨头通用电气被剔除道琼斯工业平均指数,药店连锁店沃博联(Walgreens Boots Alliance)将取而代之。

标普道琼斯指数董事总经理David Blitzer在一份声明中表示,

因为美国经济已经发生了变化,消费,金融,医疗,科技的地位日益提升,而工业的作用相对减弱。作为全美的连锁药店,将沃博联纳入道琼斯指数,使得道指更能代表美国经济的消费和医疗板块。

道琼斯工业股票平均价格指数是一种代表性强,应用范围广,作用突出的股价指数,是目前世界上影响最大、最有权威性的一种股票价格指数。

其成份股的选择标准包括成份股公司持续发展,规模较大、声誉卓著,具有行业代表性,并且为大多数投资者所追捧。目前,道琼斯工业平均指数中的30种成份股是美国蓝筹股的代表,因此,道琼斯指数被视为美国经济的晴雨表。

David Blitzer在还表示,通用电气的股价过低,目前所占权重不到0.5个百分点。而沃博联的股价更高,对指数的意义更大。

截至6月19日美股收盘,通用电气股价下跌1.89%,报12.95美元/股,被剔除出道指的消息发布后,该股盘后再跌1.39%。

反观沃博联,截至收盘,当天小幅上涨0.72%,报64.61美元/股;宣布被纳入道指的后,盘后大涨3.37%。

对道琼斯指数来说,剔除通用电气,也是具有标志性意义。因为,它标志着道琼斯指数最初的30只股票全部更新换代。

创立时,道琼斯指数只包含12只股票,1928年扩容至30只。除了通用电气,最初的12只股票包括:

美国棉花油制造公司,现为联合利华的一部份;

美国糖类公司;

美国烟草公司;

芝加哥燃气公司,在1897年被Peoples Gas Light &; Coke Co.收购(现为人民能源公司);

蒸馏及家牛饲料公司,现为千禧化学公司

拉克利德煤气灯公司

国家铅业公司,现为NL Industries

北美公司,在1940年代破产;

田纳西煤、铁与铁路公司,在1907年被美国钢铁收购;

美国皮草公司,1952年解散;

美国橡胶公司,1967年改名为Uniroyal,1990年被米其林收购。

自1928年以来,仅用于计算道琼斯工业股票价格平均指数的30种工商业公司股票,已有30次更换,几乎每两年就要有一个老公司被剔除。目前,道指的30家公司为:

一年股价跌去50%

要注意的是,按总市值计算,通用电气市值达到了1155亿美元,比目前道琼斯指数中很多工业企业的市值都高。可惜,道琼斯指数看重的不是市值,而是股价。这也是通用电气被剔除的原因——股价跌得太惨了。

通用电气股价跌得到底有多惨,看看它的月K图就明白了。今年以来,累计跌幅25.78%;过去12个月,累计跌幅52.70%;2017年至今,跌去59.01%。

通用电气曾经的辉煌不必赘述:上世纪90年,它一度成为美国市值最大的企业;2008年,还是全球五大上市公司之一。

但如今的通用电气困难重重——业绩下滑、业务冗余和现金流萎缩。

通用电气2017年财报显示,公司的业务板块繁多,包括电力、新能源、油气、航空、医疗健康、交通、照明和资本。

但2017年,其利润竟大幅下滑57%,仅有66亿美元,其中,工业板块利润下滑29亿美元。而在2017年第四季度,公司就亏损了近100亿美元。

而且,2017年每股净亏损达到0.72美元。

业绩到底有多差,看看高管们的收入就知道了。今年3月,通用电气宣布,由于2017财年业绩欠佳,决定取消其绝大多数高管的奖金,这也是公司126年历史上首次,此举为公司节省了数千万美元。

所有高管中只有一人获得了奖金,即GE航空业务负责人大卫-乔伊斯(David Joyce)。他2017年获得了140万美元奖金,但与2016年相比也大幅下降,他的总薪酬从2016年的1260万美元降至520万美元。

此外,通用电气还面临巨大的现金流问题,2017年,主营业务的现金净流入大幅下滑63.33%,仅有110亿美元。

通用电气财报不好看,除了业绩不佳之外,还有剥离部分业务的因素。2017年下半年,John Flannery就任CEO后表示,公司现在的现金流已经到了不可接受的地步,要在最快的时间内对业务进行精简调整的同时开始严控成本,并削减50%的股息。一个月后,公司就宣布将电力部门裁员1.2万人。他还表示,通用电气未来只关注三大业务:电力、航空和医疗设备。

去年10月,在发布了2017年三季度财报后,新任CEO承诺,未来将剥离掉价值200亿美元的资产。

今年5月,通用电气作价111亿美元,将旗下运输业务部门与铁路设备制造商西屋制动公司合并,通用电气及其股东将持有合并后公司的50.1%的权益。

此外,通用电气正在为自己的保险业务寻求买家,去年四季度财报披露,通用电气为保险业务计入一笔62亿美元的减值准备支出。

General Electric loses place in elite Dow Jones Industrial Average

Noel Randewich, Alwyn Scott

JUNE 19, 2018 / 5:43 PM / UPDATED 2 HOURS AGO

https://www.reuters.com/article/us-walgreens-boots-ge/walgreens-to-replace-ge-in-dow-jones-industrial-average-idUSKBN1JF359

(Reuters) - General Electric Co has lost its spot in the Dow Jones Industrial Average after over a century in the blue chip stock index, a new blow to a company that once towered over the American business landscape but is now struggling to retain its standing as an industrial powerhouse.

S&P Dow Jones Indices said on Tuesday that GE (GE.N), an original member of the Dow when it was formed by Charles Dow in 1896 and a continuous member since 1907, will be replaced in the 30-component stock average by drug store chain Walgreens Boots Alliance Inc (WBA.O) prior to the start of trading on June 26. GE’s stock slipped 1.5 percent in after-hours trading following the announcement while Walgreens jumped 3 percent.

A decade and a half ago GE was the world’s most valuable public company. But it foundered in several key industrial markets in recent years, and a diversion into financial services steered it into the eye of the global financial crisis in 2008.

It now ranks as the sixth smallest member of the Dow by market value and carries the index’s lowest stock price, making it the least influential component of the price-weighted average.

Faced with weak profits and calls to be broken up, the 126-year-old company is aggressively cutting costs, selling businesses and trying to strengthen its balance sheet under new managers and a new board.

Its stock has fallen nearly 80 percent from highs in 2000. Last month, Chief Executive John Flannery warned that GE may not be able to pay its 2019 dividend.

“It was at one time perhaps one of the quintessential U.S. companies, and like others that have been taken out of the Dow, it’s a reflection that they’re no longer seen in that light,” said Rick Meckler, a partner at Cherry Lane Investments, a family investment office in New Vernon, New Jersey.

WALGREENS HELPS REFLECT U.S. ECONOMY

The shifting sands of the Dow are testament to the various companies that were unassailable household names for decades before becoming the victims of an evolving economy. Some simply disappeared, while others found new life even if they did not reclaim their prior economic influence. They include Eastman Kodak, Sears Roebuck, International Paper, Goodyear, Bethlehem Steel, Westinghouse, General Motors Co (GM.N) and Chrysler.

Co-founded by inventor Thomas Edison, GE was the largest U.S. company by stock market value starting in 1993, with brief interruptions from Microsoft Inc (MSFT.O) until Exxon Mobil Corp (XOM.N) overtook it in 2005.

With the addition of Walgreens, the Dow will better reflect the role of consumers and healthcare in the U.S. economy, S&P Dow Jones Indices said in a statement.

While analysts had anticipated GE’s exit from the Dow because of its falling share price, it is a blow to the company to lose its status as the only original member of the iconic index. GE did leave the Dow after the index was founded in 1896 but rejoined in 1907 and has been a constant member since then, according to S&P Dow Jones Indices.

In a statement, GE said: “We are focused on executing against the plan we’ve laid out to improve GE’s performance. Today’s announcement does nothing to change those commitments or our focus in creating in a stronger, simpler GE.”

Some index watchers had expected GE’s troubles to lead to its removal from the elite index.

Not all companies that have lost their place in the Dow have gone to their graves. Bank of America Corp (BAC.N) has outperformed the Dow by 46 percentage points since it was removed in 2013.

GE had fallen on hard times even as former Chief Executive Jeffrey Immelt sought to jettison ailing businesses and focus on the company’s industrial roots in power plants, jet engines, locomotives and other large equipment. Its industrial software business did not perform as expected, forcing GE to scale in its ambitions last year.

Immelt also built up GE’s exposure to manufacturing and servicing coal and gas-fired electricity plants, only to see demand for such plants fall dramatically in recent years as sales of suddenly cost-competitive renewable wind and solar systems increased.

Aiming to generate cash and restore profitability, CEO John Flannery, who took over from Immelt last August, is exiting $20 billion in additional GE assets, including the locomotive business and a unit that makes small power-plant engines.

Changes to the Dow are made on an as-needed basis and selection is not governed by quantitative rules, according to published methodology for the index.

Reporting by Noel Randewich and Alwyn Scott; Additional reporting by Caroline Valetkevitch in New York and Supantha Mukherjee in Bengaluru; Editing by Leslie Adler and Lisa Shumaker